BLUEPRINTS

TO BELIEVE IN

40% of Americans won’t have enough money to retire, and that number hits especially hard in marginalized communities.

At TIAA, we believe in the right to retire securely. That’s why, throughout 2024, we will highlight real individuals’ success stories, showcasing diverse paths to financial goals. Swipe through their Blueprints to Believe In for unique perspectives on building a brighter future.

Marie

McFadden

Senior Manager,

Client Services Robotics

I grew up in a Marine family that moved around often, but we made great friends along the way!

After graduating college, my main focus was simply paying the bills.

As my career progressed, I could save more money and build my retirement.

I got a brand new car, something I’d never do again due to the high monthly payments.

My divorce took half my retirement, so I had to work hard to recover.

Despite this, we sent my son to college without debt.

Now that the house is nearly paid off, I’m more settled financially and look forward to eventually retiring and volunteering more at animal rescues.

Advice I’ve Lived By

Research before big purchases.

Looking back, I regret buying a new car because the depreciation is immediate and you’ll never get that money back.

Every little bit counts.

Keep contributing to your retirement, even when you think you can’t afford to or you’ll get around to it later. Even the tiniest amount goes a long way.

The future is closer than it seems.

Focus on your goals and keep moving forward. Time flies and before you know it, you’ll be moving forward to your next adventure!

For veterans and military families building their future:

It’s never too late to start, and any amount is never too little.

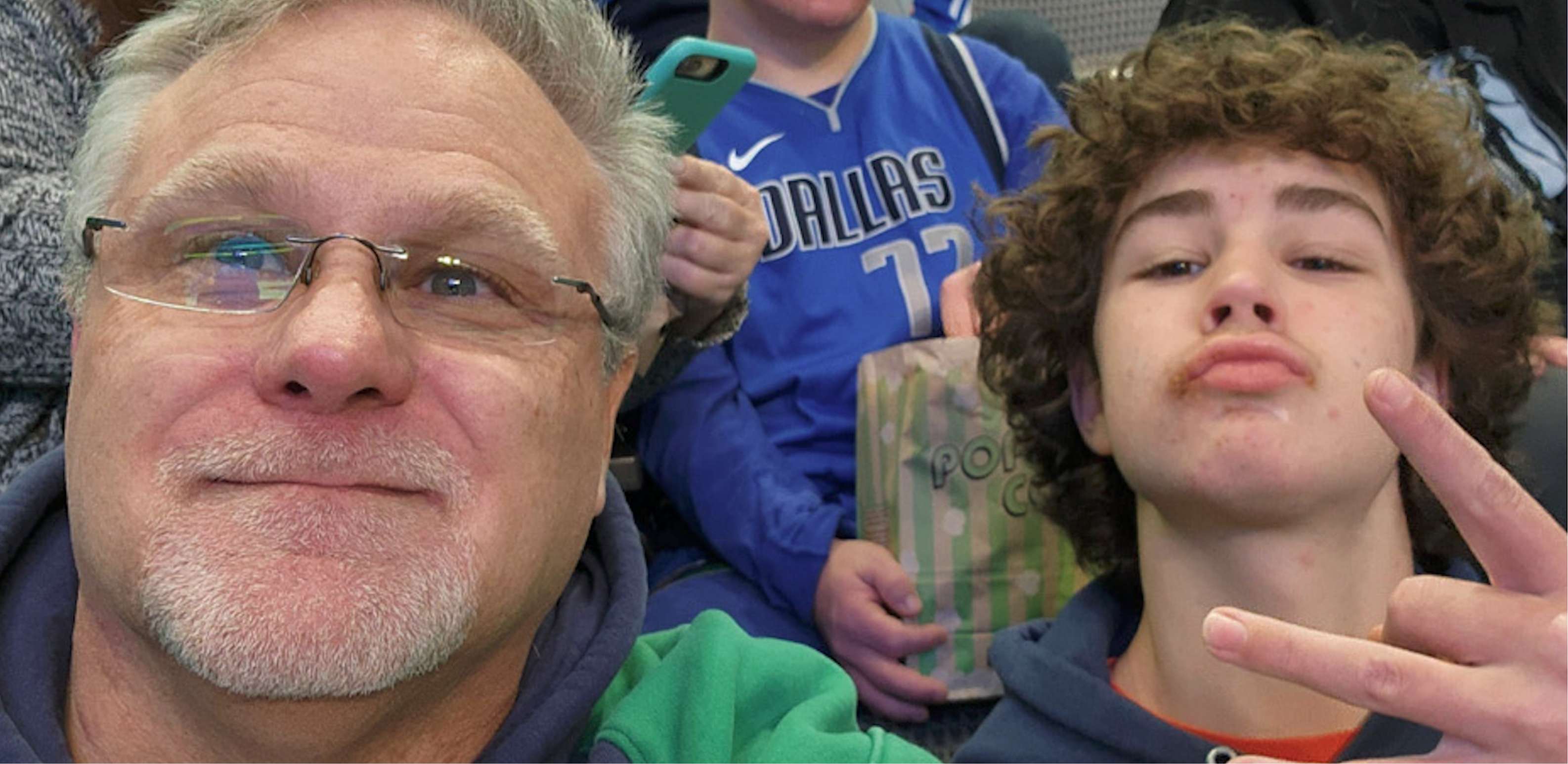

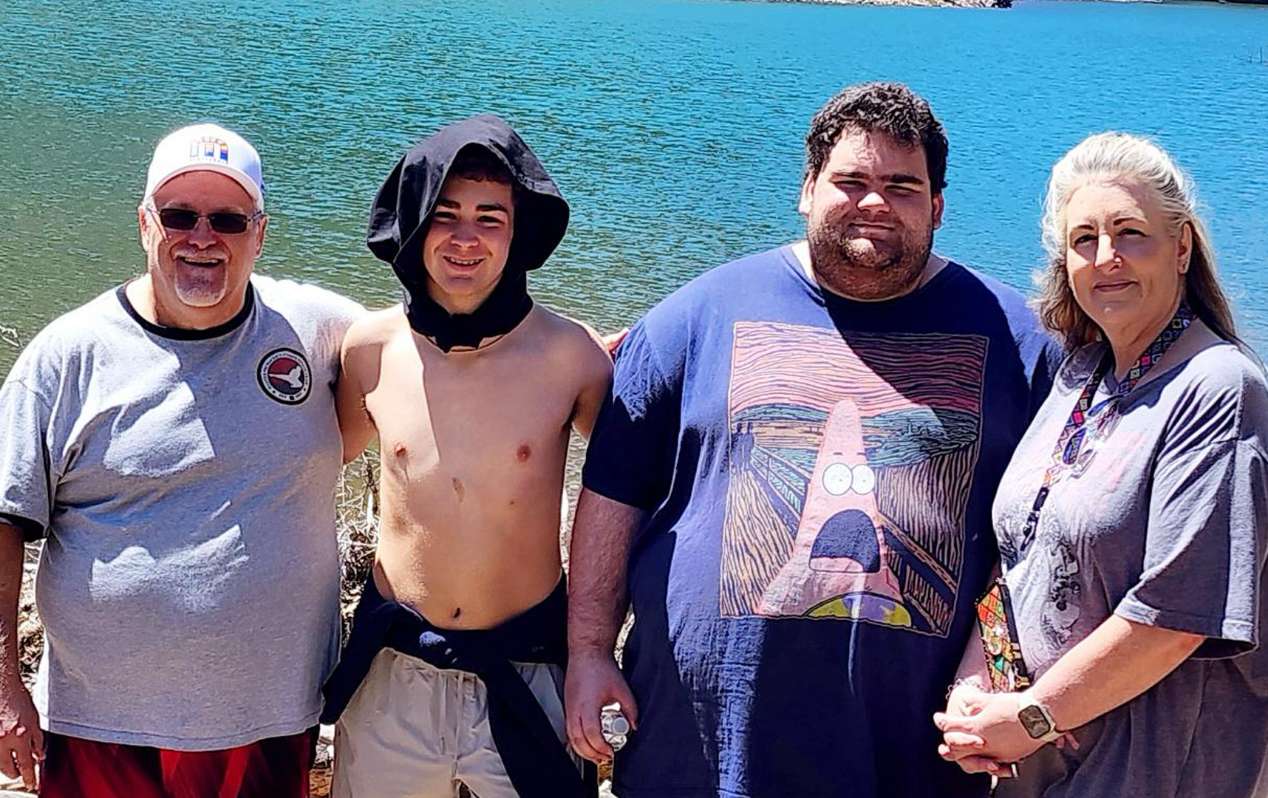

Beau

Taylor

Manager, Advice

Product Management

I grew up in Denver, CO.

I met my wife through a dating service. We were married in 2000 and soon started our family.

My wife was unexpectedly diagnosed with Multiple Sclerosis.

Shortly after, I lost my job, and our savings were depleted.

I underwent surgeries for a perforated colon.

Now, we are rebuilding our finances and planning to see our two boys through college.

When the dust settles, we dream of spending our retirement traveling the world.

Advice I’ve Lived By

Save a portion of each paycheck.

This is important in covering you and your family for any unexpected costs life throws at you and setting yourself up for success in the long run.

Expect the unexpected.

Both my wife and I faced totally unforeseen medical complications, depleting our savings and retirement. An emergency fund would’ve been extremely beneficial.

Get life insurance while you’re young.

I could have easily passed due to the perforation in my colon, and we had no additional life insurance beyond what my employer offered. Additional insurance is crucial.

For veterans and military families building their future:

Definitely plan as much as possible to handle whatever life throws at you!

Jared

Heintz

Director, Executive

Information Security

Response Manager

I grew up in rural Tennessee with a desire to work on automobiles but a mindset to go further.

I started working at the age of 14 so that I could have some independence.

I enlisted in the US Coast Guard.

I quickly moved up the ranks and became a Chief Warrant Officer specializing in cybersecurity.

I retired with a full pension and disability compensation after 20 years, which ultimately brought me financial freedom.

I began a second career at TIAA, which has been the best experience since retiring from the service.

Advice I’ve Lived By

The right mentor is gold.

When I enlisted in the Coast Guard, I met a Chief Petty Officer who set me on the right financial path. He taught me that saving young and “paying yourself first” was the only way to go. I’d tell everyone to listen to those who have been in your shoes.

Learning is lucrative.

The military offered a course in financial planning, where I learned about savings, debt and investing. This experience made me a huge advocate of self-development. Seize learning opportunities to better your future.

Don’t leave money on the table.

Not everyone gets to retire with a pension at 40, but you can shape your financial future by taking advantage of opportunities like your retirement plan. Look for ways to reach your own financial freedom.

For veterans and military families building their future:

Find your passion in life and make it your career. I am a certified industrial electrician, robotics programmer, and have degrees in Intelligence Studies and Business Administration, but my passion is in cybersecurity. If you find that passion, you won’t feel like you’re working, and you will almost always achieve upward mobility.

Umair

Zaman

Individual

Financial Consultant

I was raised in Brooklyn, NY by Pakistani immigrants.

My father settled us in the safest neighborhood we could afford, but there wasn’t a lot of extra money.

I joined the US Marines and was deployed to Iraq.

After four years, I was about to leave when my sister began planning her wedding.

As a young man, I applied for a credit card and quickly maxed it out, which was a big wakeup call.

I stayed in the military longer than planned so I could help support my family, including covering my sister’s wedding.

I got married, had 2 children, and helped with my other sister’s wedding.

I purchased a house, becoming the first in my family to own a home.

Advice I’ve Lived By

Invest in your loved ones.

Having the means to help both my sisters with their weddings was incredibly rewarding. I was able to see the value of being financially secure and how it led to the direct betterment of my family.

Small investments pay off.

I invested just $50 per paycheck in my job’s stock purchase plan. The investment allowed me to make a significant contribution towards my second sister’s wedding.

Take the plunge.

Buying my first home was intimidating because I’d heard others’ bad experiences. But it turned out to be one of the best investments of my life. Consistency and research are key to confident financial decisions.

For veterans and military families building their future:

Begin today! Kickstart by opening a simple savings account and cultivate the strong habit of setting aside money every paycheck without dipping into it.